Business Incorporation

Business incorporation involves the legal process of forming a distinct and separate entity from its owners. This shields personal assets, limiting liability. To initiate this process, one typically selects a business structure (such as LLC, corporation, or partnership), registers with the appropriate authorities, and complies with regional regulations. Each structure has distinct advantages regarding liability protection, taxation, and operational flexibility. Business incorporation establishes a foundation for legitimacy and credibility, often enhancing access to funding and attracting potential clients. It is a crucial step for entrepreneurs seeking long-term stability and growth in the competitive business landscape.

Incorporating Success: Business Legalities Unveiled.

Navigating Business Incorporation: Legal Essentials, Structuring Options, and Key Steps for Establishing a Strong Foundation at f-talk Private Limited.

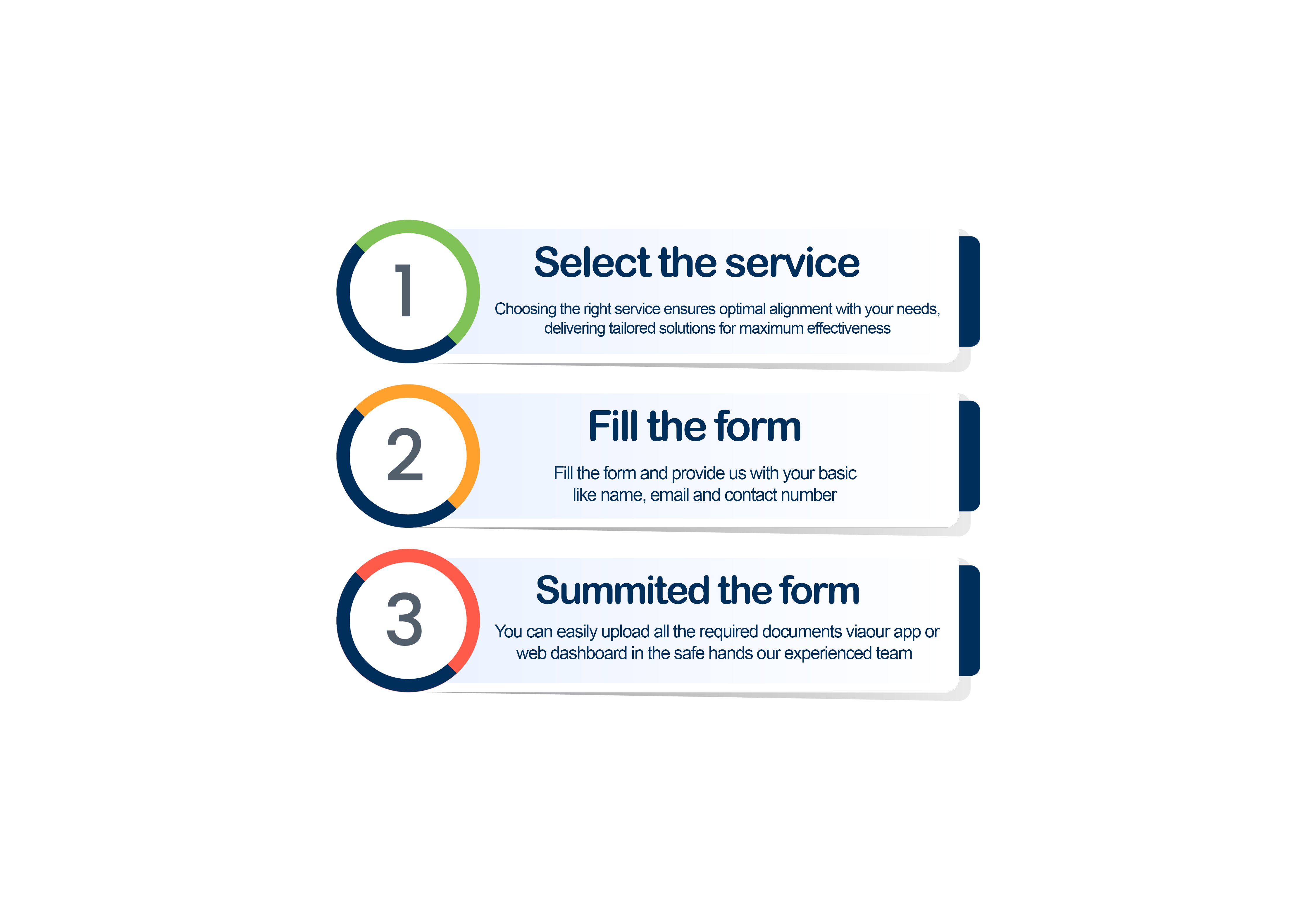

The steps to incorporate a business involve several legal requirements and a defined process. Initially, businesses need to choose a legal structure, such as an LLC or corporation, and select a unique business name. Following this, the formation documents, often articles of incorporation, must be prepared and filed with the appropriate state authorities.

Conduct a thorough search to ensure the desired business name is unique and not already in use by another entity. Check state and local business registries, domain names, and trademarks.

The differences between incorporation and other business structure options revolve around aspects such as legal entity, liability, taxation, ownership structure, and operational flexibility. Incorporation, typically forming a distinct legal entity, offers limited liability protection and allows for easier transferability of shares. In contrast, other structures like sole proprietorship, partnership, or LLC may not create a separate legal entity and can involve different levels of personal liability.