Income Tax

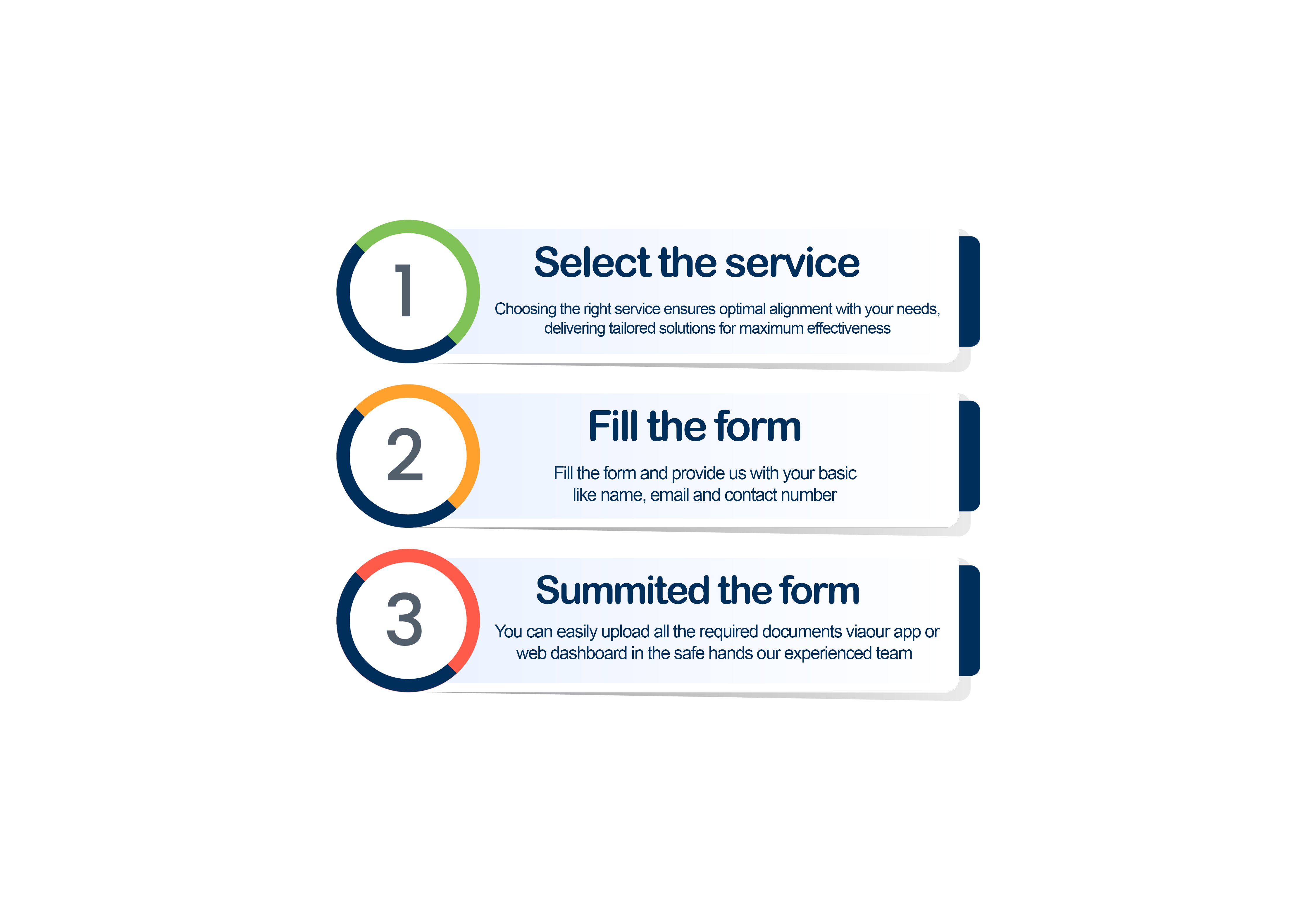

f-talk Private Limited diligently adheres to Income tax regulations in all content-related financial transactions. We ensure accurate reporting of revenue, expenses, and applicable deductions. By staying compliant with tax laws, we aim to mitigate risks and contribute responsibly to the public finances. Our financial team collaborates with tax professionals to optimize tax strategies, identifying eligible credits and incentives within the content industry. This proactive approach enables us to meet our tax obligations while maximizing financial efficiency in content-related Income and expenditures.

Content Finance: Tax Compliance Strategies

Optimizing content Income, ensuring compliance with tax laws, and leveraging strategic financial management for sustainable growth at f-talk Private Limited.

The tax implications of diverse investment strategies vary based on factors such as the type of investment, holding period, and individual tax circumstances. For example, capital gains from the sale of investments may be subject to different tax rates, depending on whether they are short-term or long-term. Dividend Income and interest Income are also taxed differently.

Economic indicators play a crucial role in shaping investment decisions by providing insights into the overall health and direction of the economy. Key indicators, such as GDP growth, unemployment rates, inflation, and interest rates, influence investor sentiment and market trends.

Investing in cryptocurrencies comes with both benefits and risks. On the positive side, cryptocurrencies offer the potential for high returns, diversification, and accessibility, allowing individuals to participate in decentralized financial systems. Blockchain technology, which underlies cryptocurrencies, provides transparency and security. However, risks include extreme price volatility, regulatory uncertainties, and the potential for security breaches.